8 Simple Techniques For Unicorn Financial Services

Wiki Article

Everything about Loan Broker Melbourne

Table of ContentsThe Definitive Guide for Broker MelbourneGetting My Home Loan Broker Melbourne To WorkNot known Details About Refinance Broker Melbourne The Greatest Guide To Broker MelbourneOur Refinance Melbourne IdeasNot known Factual Statements About Refinance Broker Melbourne

Mortgage brokers can aid those that have trouble receiving a mortgage! Home mortgage brokers are flexible and intend to see you succeed in acquiring a house. Not only that, home mortgage brokers can assist whether you are purchasing or aiming to re-finance. A re-finance can be useful in many circumstances, like if you lately did some home renovations or desire to decrease your interest price - mortgage broker melbourne.One point virtually every house purchaser is on the search for is affordability. Working with a broker means acquiring your residence at wholesale and not retail, which can assist you out on rate of interest rates.

The Only Guide for Mortgage Broker In Melbourne

Eagle Home mortgage Firm desires to aid get you there. Occasionally points obtain in the means, as well as we discover that working with financial institutions is one of those things.We lie in Omaha, NE, yet assistance throughout Nebraska and also Iowa!.

When buying for a home mortgage, many home buyers get the services of a Home mortgage Specialist. There are several benefits to making use of a Home loan Broker and I have actually compiled a checklist of the top 8: 1.

About Broker Melbourne

Conserves you cash Home loan Brokers, if they are effective, have accessibility to marked down prices. Since of the high volume that they do, lending institutions make offered affordable rates that are not available directly via the branch of the lending institution that you go to. It can be very challenging to discover a home mortgage.Your Mortgage Broker will make sure all the documentation is in place. Provides you accessibility to loan providers that are otherwise not readily available to you Some lenders work specifically with Home loan Brokers.

5. Solutions are cost-free Home loan Professionals are paid by the loan provider and not by you. This is not a downside to you. A great Home mortgage Broker will certainly constantly have the best interest of the customer in mind due to the fact that if you, as a client, enjoy, you will certainly go inform your good friends regarding the solution you have actually gotten from the Home loan Expert you deal with.

Indicators on Unicorn Financial Services You Should Know

6. Take on every obstacle As Mortgage Experts, we see every situation around and work to make certain that every customer recognizes what is readily available to them for financing choices for a home loan. Harmed debt and low home income could be a deterrent for the financial institution, but a Home loan Expert understands how to approach the loan provider and also has the connection to make certain every customer has a strategy as well as strategy in position to see to it there is a mortgage in their future.

8. The Home mortgage Broker has a much better understanding of what home loan items are available than your bank Remarkably, a Home Mortgage Broker needs to be accredited and also can not discuss home loans with you unless they are accredited. This is unlike the financial institution who can "inside train" their personnel to market the details items available from their bank. https://topusabizdirectory.com/mortgage-broker/unicorn-financial-services-springvale-victoria/.

The Definitive Guide to Mortgage Broker In Melbourne

While this is not an exhaustive list on the benefits of utilizing a Home mortgage Professional, it is engaging to see the benefits of utilizing a Home loan Specialist instead than putting a mortgage with each other by yourself (https://baileybizlistings.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). At Dominance Loaning Centres, we have an excellent relationship with the loan providers we introduce our customers to.

We are always expert and we always see to it our clients understand every feasible choice they have for mortgage financing.

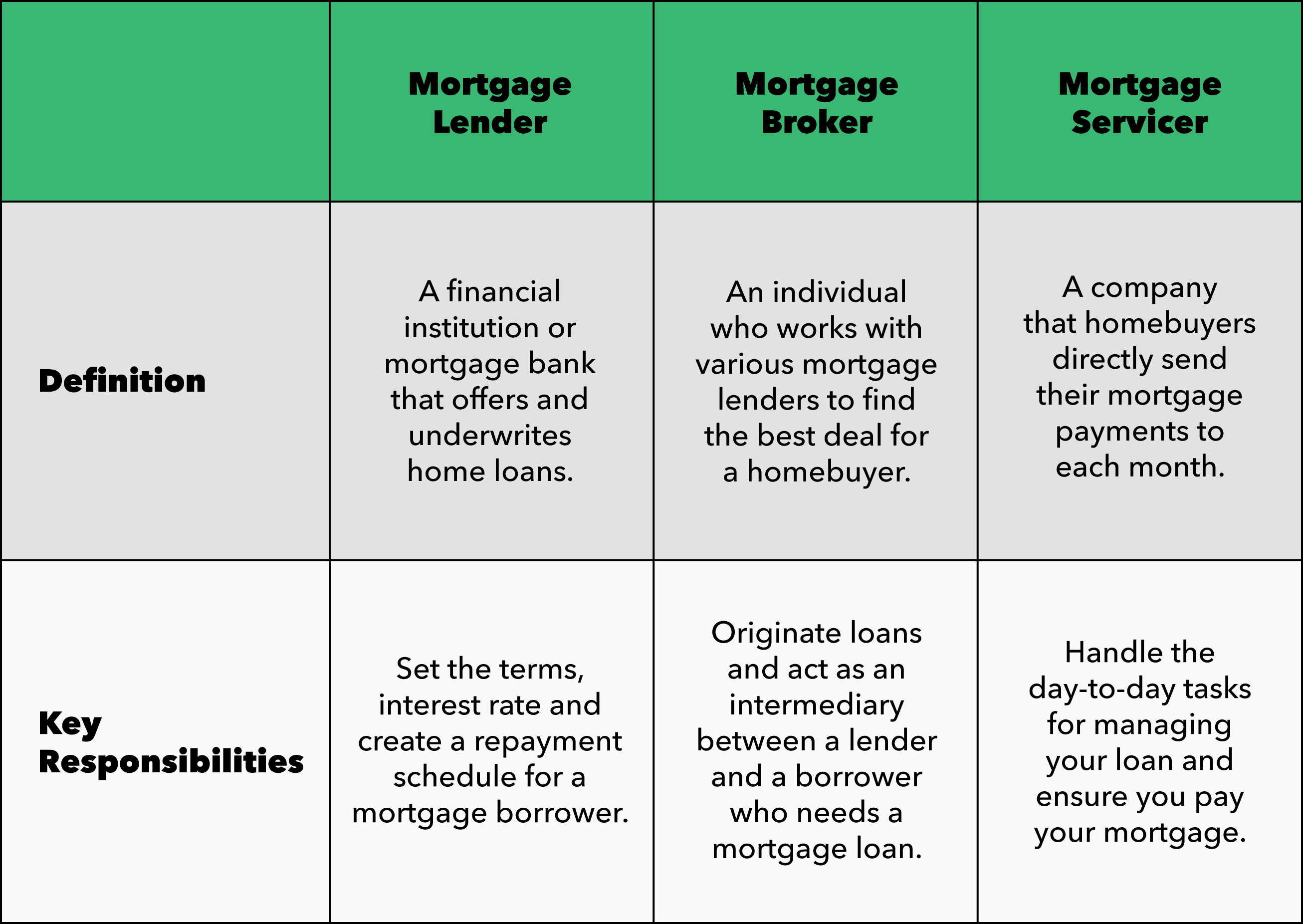

A home mortgage broker can assist if you desire support filtering with car loan choices, determining the most effective rates of interest or getting over complex borrowing obstacles. You can go shopping for a residence finance by yourself, a home mortgage broker serves as a matchmaker to link you with the appropriate lender for your demands - mortgage broker in melbourne. A home mortgage broker, unlike a home loan lender, does not fund fundings but instead assists you find the ideal lender for your financial scenario. Home mortgage brokers are accredited and controlled financial professionals who act as a bridge between borrower and loan provider. A broker can have accessibility to a variety of loan providers, which may provide you a larger choice of products and terms than a direct loan provider.

Unicorn Financial Services Things To Know Before You Get This

Brokers can originate car click loans and take care of the authorization procedure, which can save you time, but they do not close home loans themselves. After you choose a perfect loan provider, your broker will certainly assist you assemble your paperwork, send it to an expert as well as order a residence appraisal. When you are gotten rid of to close, the mortgage broker will begin to plan for closing day.Report this wiki page